Econometrics

Econometrics is a branch of economics. It is the use of statistical and mathematical methods to describe the relation between economic forces such as capital (any of the tools, work, or other things needed to make something useful), interest rates (the price of borrowing money), and labor.

Much of econometrics is making models which are simple pictures of the real world. These models then can be used to predict what will happen in the real world.

An example of econometrics would be looking at the prices of houses in a town. An economist (someone who studies economics) can try to make a simple picture of the house prices in the town. This picture might show that houses close to the market are worth more. An economist could then say that if a new market is made in another part of the town, home prices there might go up. The economist also might say that the new market could make prices less than before near the old one, because the new market will make it so that more houses are near a market. This would make the people who sell houses near a market sell them for less, since there could be more sellers than buyers.

Basic model: linear regression[change | change source]

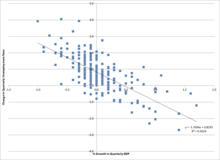

A basic tool for econometrics is the multiple linear regression model.[1] In modern econometrics, other statistical tools are often used, but linear regression is still the most used starting point for an analysis.[1] Estimating a linear regression on two variables can be shown by drawing a line through data points representing paired numbers of the independent and dependent variables.

References[change | change source]

- ↑ 1.0 1.1 Greene, William (2012). "Chapter 1: Econometrics". Econometric Analysis (7th ed.). Pearson Education. pp. 47–48. ISBN 9780273753568.

Ultimately, all of these will require a common set of tools, including, for example, the multiple regression model, the use of moment conditions for estimation, instrumental variables (IV) and maximum likelihood estimation. With that in mind, the organization of this book is as follows: The first half of the text develops fundamental results that are common to all the applications. The concept of multiple regression and the linear regression model in particular constitutes the underlying platform of most modeling, even if the linear model itself is not ultimately used as the empirical specification.